Dec. 19 (Bloomberg) -- Thailand's government scrapped currency controls on international investors one day after the central bank imposed them and sent the stock market plunging by the most in 16 years.

Dec. 19 (Bloomberg) -- Thailand's government scrapped currency controls on international investors one day after the central bank imposed them and sent the stock market plunging by the most in 16 years.The government is removing a requirement that banks lock up 30 percent of new foreign-currency deposits for a year, Finance Minister Pridiyathorn Devakula said in Bangkok.

"The stock market has fallen too much today,'' Pridiyathorn told reporters at a press conference.

"This is the side effect of the central bank's measure, but we have fixed it already.''

Thai stocks erased $23 billion of their market value today after the central bank said international investors must pay a 10 percent penalty unless they keep funds in the country for a year. The currency controls triggered declines in other emerging stock markets by highlighting the risks of investing in developing economies.

The rules would have limited international investors to using 70 percent of their funds to buy Thai stocks. The requirements stay in effect on other investments, including bonds and property, Pridiyathorn said

Thailand's SET Index tumbled 15 percent to its lowest since Oct. 29, 2004. The index sank 108.41 to 622.14. Morgan Stanley Capital International's Emerging Markets Index fell 1.6 percent to 881.31 as of 2:33 p.m. in London.

Restoring Confidence

``It's very untimely, it's unwarranted and it's badly thought-through,'' said Teng Ngiek Lian, who oversees $1.6 billion in Asian stocks at Singapore-based Target Asset Management in Singapore, before the measures were rolled back. ``If they don't quickly restore confidence, the damage can be quite bad.''

The currency measures came after the baht appreciated to the strongest in nine years, even though the central bank this month introduced steps to limit gains. The monetary authority on Dec. 4 asked companies and commercial lenders not to sell baht short-term debt securities to overseas investors.

The baht had the biggest two-day decline since April 2005 on yesterday's measures.

A military coup on Sept. 19 ousted prime Minister Thaksin Shinawatra and ended seven months of political turmoil. Prime Minister Surayud Chulanont, installed by the military junta after the coup, is planning record spending on roads, subways and other infrastructure projects.

International investors sold 25.1 billion baht ($699 million) more of Thai stocks than they bought today, the largest net sales since at least Jan. 4, 1999, according to data compiled by Bloomberg.

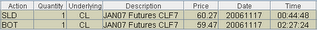

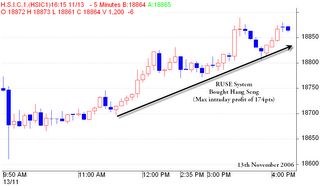

Although my system is over 90% accurate and only generate 1 stop loss in 5 years, I have to acknowledge the fact that Nikkei, Hang Seng and SIMSCI ended up strongly nearer to their highs. At the same time, this system is mechanical so taking every trade is necessary for consistent profitability.

Although my system is over 90% accurate and only generate 1 stop loss in 5 years, I have to acknowledge the fact that Nikkei, Hang Seng and SIMSCI ended up strongly nearer to their highs. At the same time, this system is mechanical so taking every trade is necessary for consistent profitability.

Today, our home-grown SIMSCI did an amazing run, one-way traffic to the north pole from start till end. With Taiwan, Nikkei and Kospi ending near their highs, it's 2nd nature for me to buy August SIMSCI after lunch @ 286.0. I was not surprised that subsequently Hang Seng and SIMSCI also ended at their highs. Repeated patterns after all. I look forward to a strong move in US markets tonight. Once again, let's stand up for Singapore :)

Today, our home-grown SIMSCI did an amazing run, one-way traffic to the north pole from start till end. With Taiwan, Nikkei and Kospi ending near their highs, it's 2nd nature for me to buy August SIMSCI after lunch @ 286.0. I was not surprised that subsequently Hang Seng and SIMSCI also ended at their highs. Repeated patterns after all. I look forward to a strong move in US markets tonight. Once again, let's stand up for Singapore :)

A brief look at all my posts so far, one can only see words, words and more words ...

A brief look at all my posts so far, one can only see words, words and more words ...