Everytime I re-read my Market Wizards book, I got something new out of it. Here an excerpt which is especially meaningful to me this time round:

"One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do. Most people always have to be playing; they always have to be doing something. They make a big play and say, "Boy, am I smart, I just tripled my money." Then they rush out and have to do something else with that money. They can't just sit there and wait for something new to develop" (from Jack Schwager's interview with Jim Rogers)

So well said, isn't it?

Thursday, June 29, 2006

Tuesday, June 27, 2006

26th June 06 - The Folks Whom I Work So Hard For ...

A brief look at all my posts so far, one can only see words, words and more words ...

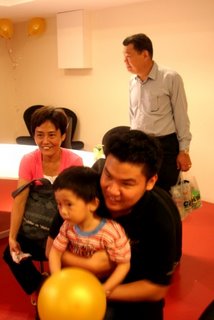

A brief look at all my posts so far, one can only see words, words and more words ...They say a picture speaks more than a thousand words. I shall dedicate this post to the folks whom meant so much to me.

They are my dad, my mum and my nephew. Thanks for everything !!! You are the reason why everything is worth fighting for :)

Sunday, June 25, 2006

25th June 06 - What Do You Foresee of Yourself 1 Year Down the Road?

One fine day, I was chatting with my friends over coffee. One of them popped this question "What do you foresee yourself to be 1 year down the road?" Typical answers like “I really don’t know”, “it depends on what my boss thinks of me” sprung up one after another.

To me, I know exactly what I want to achieve by June 2007 – to earn S$20,000 per month and to manage an S$5 million trading fund. A quantum leap from where I am now but I believe it’s possible, in fact very possible.

On that fine day, the question made me think deeper into the path I am going to take for the coming year. I realize that not only I want a decent income, I want more time to spend with my loved ones and also to do the things which I love – which is to nurture and mentor fellow traders.

In trading, time leverage can be achieved by position trading whereby trades are placed to maximize profits in the direction of the trend, sometimes lasting days to weeks or even months. Trends do take time to build up and blossom and one must be patient enough to hold on to a favorable position longer to reap more profits. At the end of the day, I want to spend less time looking at the markets and yet make more $$. Who doesn’t?

Currently, 99% of my trades are intra-day trades and I only remembered a handful of position trades throughout my one and half year of trading. Moving from a intra-day scalper to that of a position trader might seemed to be a quantum leap however if the switch is done in steps, it should be manageable. One of my immediate milestones is to convert 30% of my trades to position trades by end Sept 06.

On Friday, I decided to take a small step towards achieving my goal. After hours of looking at the market, I decided to initiate a position trade. Interestingly, at times, the ‘chicken little’ side of me would pop up and say things like “maybe it’s not a good idea, let’s do it some other time”. However, after gauging that I have 84% chance of profiting from this trade with limited downside risk, I decided to go ahead.

For that, I bought Taiwan @ 269.6.

I am so happy that I made the 1st step towards my goal and I hope you would do the same too :)

PS: I am now at the final stages of back-testing two position trading systems. They are armed with an amazing 90% accuracy and up to 25% of the entries are market turning points. I traded them and made $$. Exciting stuff, ya? Watch this space...

To me, I know exactly what I want to achieve by June 2007 – to earn S$20,000 per month and to manage an S$5 million trading fund. A quantum leap from where I am now but I believe it’s possible, in fact very possible.

On that fine day, the question made me think deeper into the path I am going to take for the coming year. I realize that not only I want a decent income, I want more time to spend with my loved ones and also to do the things which I love – which is to nurture and mentor fellow traders.

In trading, time leverage can be achieved by position trading whereby trades are placed to maximize profits in the direction of the trend, sometimes lasting days to weeks or even months. Trends do take time to build up and blossom and one must be patient enough to hold on to a favorable position longer to reap more profits. At the end of the day, I want to spend less time looking at the markets and yet make more $$. Who doesn’t?

Currently, 99% of my trades are intra-day trades and I only remembered a handful of position trades throughout my one and half year of trading. Moving from a intra-day scalper to that of a position trader might seemed to be a quantum leap however if the switch is done in steps, it should be manageable. One of my immediate milestones is to convert 30% of my trades to position trades by end Sept 06.

On Friday, I decided to take a small step towards achieving my goal. After hours of looking at the market, I decided to initiate a position trade. Interestingly, at times, the ‘chicken little’ side of me would pop up and say things like “maybe it’s not a good idea, let’s do it some other time”. However, after gauging that I have 84% chance of profiting from this trade with limited downside risk, I decided to go ahead.

For that, I bought Taiwan @ 269.6.

I am so happy that I made the 1st step towards my goal and I hope you would do the same too :)

PS: I am now at the final stages of back-testing two position trading systems. They are armed with an amazing 90% accuracy and up to 25% of the entries are market turning points. I traded them and made $$. Exciting stuff, ya? Watch this space...

Wednesday, June 21, 2006

21st June 06 - Trading on News (Part 1)

Thanks for all the wonderful feedback. Really appreciate it :) Let me illustrate my simple way of trading on news with an example so that you can understand better ...

Let's talk about interest rates hikes since it seemed to be the buzz of the town. Everyone (no, I'm not exaggerating) I know is talking about it, regardless whether they really know it or not. The next news we can trade on (and possibly make $$) is the hiking of interest rates by Bank of Japan (BOJ). There's speculation that it might come as early as July... slurp slurp ... The fact remains thet interest rate hikes hurt equities and may cause major sell-off in the Japanese Nikkei market.

For my system, there's two trades you can look out for: "follow-thru" and "reverse swing".

For "follow thru", you may trade alongside the crowd. For this example, on the day BOJ announce the rate hike, you might consider to short Nikkei as the 'propaganda' of interest rate hikes hurting equities will sink in and everyone from japanese rice farmers to sophiscated fund managers will start dumping their Japanese stocks. Another example of "follow-thru" can be seen in 17th Sept 2001, the 1st day the market re-opened after Sept 11 terroist attacks. On that day, Dow Jones shed 684.4 pts and the sell-off continues for days.

Dear friends, pls take note that "follow-thru" does not work for stock analysts recommendations. It might not be a good idea to buy alongside the crowd when the analysts call for a buy in a certain stock. Do think about it, if the stock that they are recommending is so good, why are they not buying for themselves?

Remember, you only trade alongside the crowd when even the smart money joins the crowd. Such situations happen when there are mass fear (Sept 11, London bombings) or pivotal events (interest rate hikes or cuts).

I hope everyone gain something today :) Before I bring fro "reverse swing" in my next post, do feel free to post any comments/questions/feedback about "follow-thru". (Click on COMMENTS below)

Let's learn from one another, ya?

Disclaimer: The above information are for educational purposes only. I shall not held responsible for the profits or losses for any trades participated.

Let's talk about interest rates hikes since it seemed to be the buzz of the town. Everyone (no, I'm not exaggerating) I know is talking about it, regardless whether they really know it or not. The next news we can trade on (and possibly make $$) is the hiking of interest rates by Bank of Japan (BOJ). There's speculation that it might come as early as July... slurp slurp ... The fact remains thet interest rate hikes hurt equities and may cause major sell-off in the Japanese Nikkei market.

For my system, there's two trades you can look out for: "follow-thru" and "reverse swing".

For "follow thru", you may trade alongside the crowd. For this example, on the day BOJ announce the rate hike, you might consider to short Nikkei as the 'propaganda' of interest rate hikes hurting equities will sink in and everyone from japanese rice farmers to sophiscated fund managers will start dumping their Japanese stocks. Another example of "follow-thru" can be seen in 17th Sept 2001, the 1st day the market re-opened after Sept 11 terroist attacks. On that day, Dow Jones shed 684.4 pts and the sell-off continues for days.

Dear friends, pls take note that "follow-thru" does not work for stock analysts recommendations. It might not be a good idea to buy alongside the crowd when the analysts call for a buy in a certain stock. Do think about it, if the stock that they are recommending is so good, why are they not buying for themselves?

Remember, you only trade alongside the crowd when even the smart money joins the crowd. Such situations happen when there are mass fear (Sept 11, London bombings) or pivotal events (interest rate hikes or cuts).

I hope everyone gain something today :) Before I bring fro "reverse swing" in my next post, do feel free to post any comments/questions/feedback about "follow-thru". (Click on COMMENTS below)

Let's learn from one another, ya?

Disclaimer: The above information are for educational purposes only. I shall not held responsible for the profits or losses for any trades participated.

Sunday, June 18, 2006

18th June 06 - Facts, Do They Matter ???

"The trouble with facts is that there are so many of them."

- Samuel McChord Crothers

This quote is so true. In trading, we are bombarded by tons of facts and news, possibly explaining every movement of the market. One moment, when the market soars, the headlines boast of a booming economy. The next moment, when the market comes off, the usual suspects would be 'interest rates concerns', 'bird flu', 'profit taking' and yada yada ... A irony which me and my friends usually joke about during coffee is: If there's so much profit to take, then how come 90% of the traders are still losing ??? Clueless, ya?

The interesting fact of facts and news is that they are always late. The 'stories' only comes out after it has happened and impacted the markets. However, I do have a way to make $$ outta facts and news although they are late ... Got your attention, ya?

Dear readers, I will reveal my "trading on news" system in my next post. Well, before I do that, can I borrow 1 min of your time to write down some comments (click on the COMMENT below) about my sharings so far? :)

- Samuel McChord Crothers

This quote is so true. In trading, we are bombarded by tons of facts and news, possibly explaining every movement of the market. One moment, when the market soars, the headlines boast of a booming economy. The next moment, when the market comes off, the usual suspects would be 'interest rates concerns', 'bird flu', 'profit taking' and yada yada ... A irony which me and my friends usually joke about during coffee is: If there's so much profit to take, then how come 90% of the traders are still losing ??? Clueless, ya?

The interesting fact of facts and news is that they are always late. The 'stories' only comes out after it has happened and impacted the markets. However, I do have a way to make $$ outta facts and news although they are late ... Got your attention, ya?

Dear readers, I will reveal my "trading on news" system in my next post. Well, before I do that, can I borrow 1 min of your time to write down some comments (click on the COMMENT below) about my sharings so far? :)

Friday, June 16, 2006

15th June 06 - The Day I Made S$6 From Trading

As you read the headline of this post, I know some of you may think "What's so great about making 6 bucks from trading ?" On monetary sense, well it's really insignificant but it's the reasons behind all the trades that made this day meaningful to me :)

Let me share with all my trades:

Trade 1

Bought HangSeng @ 15,400

Sold HangSeng @ 15,369 (loss of S$330)

Trade 2

Shorted Taiwan @ 266.6

Covered Taiwan @ 266.3 (profit of S$38.60)

Trade 3

Bought Taiwan @ 265.1

Sold Taiwan @ 265.2 (profit of S$6.80)

Trade 4

Shorted Taiwan @ 265.3 and 265.1

Covered Taiwan @ 265.0 and 264.1 (profit of $156.70)

Trade 5

Bought Taiwan @ 265.0

Sold Taiwan @ 265.9 (profit of $134)

As you can see, I begin the day with a loss in Hang Seng. After the loss, it sets me thinking: should I just stop for the day or should I repair this trade as much as possible? Soon after, I chose to repair the trade but only to the extent the MARKET ALLOWS ME TO. Please remember that the market doesn't owe any of us a living. It doesn't pat you on the back and say "Don't feel sad over 1st losing trade, let me give you a chance to make back you $$, ya?"

The subsequent trades (Trade 2 to 5) are all recovery trades. If you look at it closely, Trade 2 and 3 gave rather insignifant gains. The reason being, the market was starting to go against my position and if I had got it out at breakeven or small profit, they would have turned to losing trades. Imagine if I lost again after the 1st trade, it would be uphill task for me to repair. Conversely, when the market runs for me, I will maximise my gains, as seen in the last 2 trades. That's my take on "minimize the losses and maximize the gains".

Trading is all about planning, akin to running a business. After I completed each recovery trade, I would punch in my calculator to tabulate the running profit & loss so that I know exactly how much to achieve before breakeven. So now, you begin to realise that the $6 profit isn't a coincidence, ya?

The recovery trades also helped me to gain back my 'feel' of the market and re-established my winning momentum. As such, I look forward to great trading days ahead :)

PS: Recently I have received very good reviews from my readers. Thank you very much. I will continue to share.

PPS: Please do refer your friends to my blog if you find that they can benefit. Remember, what goes around comes around. It's always good to share :)

Let me share with all my trades:

Trade 1

Bought HangSeng @ 15,400

Sold HangSeng @ 15,369 (loss of S$330)

Trade 2

Shorted Taiwan @ 266.6

Covered Taiwan @ 266.3 (profit of S$38.60)

Trade 3

Bought Taiwan @ 265.1

Sold Taiwan @ 265.2 (profit of S$6.80)

Trade 4

Shorted Taiwan @ 265.3 and 265.1

Covered Taiwan @ 265.0 and 264.1 (profit of $156.70)

Trade 5

Bought Taiwan @ 265.0

Sold Taiwan @ 265.9 (profit of $134)

As you can see, I begin the day with a loss in Hang Seng. After the loss, it sets me thinking: should I just stop for the day or should I repair this trade as much as possible? Soon after, I chose to repair the trade but only to the extent the MARKET ALLOWS ME TO. Please remember that the market doesn't owe any of us a living. It doesn't pat you on the back and say "Don't feel sad over 1st losing trade, let me give you a chance to make back you $$, ya?"

The subsequent trades (Trade 2 to 5) are all recovery trades. If you look at it closely, Trade 2 and 3 gave rather insignifant gains. The reason being, the market was starting to go against my position and if I had got it out at breakeven or small profit, they would have turned to losing trades. Imagine if I lost again after the 1st trade, it would be uphill task for me to repair. Conversely, when the market runs for me, I will maximise my gains, as seen in the last 2 trades. That's my take on "minimize the losses and maximize the gains".

Trading is all about planning, akin to running a business. After I completed each recovery trade, I would punch in my calculator to tabulate the running profit & loss so that I know exactly how much to achieve before breakeven. So now, you begin to realise that the $6 profit isn't a coincidence, ya?

The recovery trades also helped me to gain back my 'feel' of the market and re-established my winning momentum. As such, I look forward to great trading days ahead :)

PS: Recently I have received very good reviews from my readers. Thank you very much. I will continue to share.

PPS: Please do refer your friends to my blog if you find that they can benefit. Remember, what goes around comes around. It's always good to share :)

Thursday, June 15, 2006

14th June 06 - Day 1 of Recovery

As mentioned in my post yesterday, I would focus mainly on getting back my 'form'. Took a small bite off the market. Long Hang Seng @ 15,305 and cleared @ 15,325. S$200 in 3mins and that's it for the day. The temptation to trade more is definitely there but I stick to my guns and trade my plan ...

Spent rest of the day mentoring fellow traders. It's always in me to share as I firmly believe that "What goes around comes around". Overall an profitable day for all who came to trade with me with each bagging in around S$200 to S$500. Cheers :)

Spent rest of the day mentoring fellow traders. It's always in me to share as I firmly believe that "What goes around comes around". Overall an profitable day for all who came to trade with me with each bagging in around S$200 to S$500. Cheers :)

Tuesday, June 13, 2006

13th June 06 - Managing Losing Streaks

These 2 days hasn't been easy, with 2 losing days back to back and taking out most of the gains for June.

A valuable lesson learnt is learning to RESPECT THE MARKET AT ALL TIMES...

Well, the 1st week of June has been smooth sailing. 90% of the trades I went in made $$ for me. It seemed that everything I touched, it will turn to gold. I even have friends asking "How do he do it man? Almost buying at the lows and selling at the highs". I guess with this, subconsciously I have begun to take the market for granted. In fact, by end of last week, I have detected that my 'form' has dipped a fair bit but I have chose not to pay much attention to it.

To me, trading is like soccer. A trader, similarly a soccer team, doesn't win all the time. There will definitely come a time where the losing streak sets in. This is the TEST where how you perceive the situation matters. Do you see as yourself as a failure or do you see it as a perfect opportunity to learn valuable lessons from your mistakes? I don't about you, but I will definitely go for the latter! I always stand by "What doesn't kill you will make you stronger"

So you may ask, how am I gonna deal with my present losing streak?

The plan is simple. As my trading 'form' is currently on a downtrend, definitely it is not wise to trade alot. Usually I trade up to 3 times a day but for the next 3 days, I will at most trade once a day. And, everytime I go in now, I am targeting to go for minimal profit. The objective is to regain the winning form. Sometimes, when you are stuck in a losing streak, it's amazing that even make 1pt from the market can be very difficult.

That's my plan for now; stay tuned for updates :)

A valuable lesson learnt is learning to RESPECT THE MARKET AT ALL TIMES...

Well, the 1st week of June has been smooth sailing. 90% of the trades I went in made $$ for me. It seemed that everything I touched, it will turn to gold. I even have friends asking "How do he do it man? Almost buying at the lows and selling at the highs". I guess with this, subconsciously I have begun to take the market for granted. In fact, by end of last week, I have detected that my 'form' has dipped a fair bit but I have chose not to pay much attention to it.

To me, trading is like soccer. A trader, similarly a soccer team, doesn't win all the time. There will definitely come a time where the losing streak sets in. This is the TEST where how you perceive the situation matters. Do you see as yourself as a failure or do you see it as a perfect opportunity to learn valuable lessons from your mistakes? I don't about you, but I will definitely go for the latter! I always stand by "What doesn't kill you will make you stronger"

So you may ask, how am I gonna deal with my present losing streak?

The plan is simple. As my trading 'form' is currently on a downtrend, definitely it is not wise to trade alot. Usually I trade up to 3 times a day but for the next 3 days, I will at most trade once a day. And, everytime I go in now, I am targeting to go for minimal profit. The objective is to regain the winning form. Sometimes, when you are stuck in a losing streak, it's amazing that even make 1pt from the market can be very difficult.

That's my plan for now; stay tuned for updates :)

Monday, June 12, 2006

12th June 06 - Believing

"You can't believe in a dream until you can believe in yourself"

Dear friends, unleash your passion in trading and bring forth your belief, and you know what, your dream might be alot closer than what you have expected. I see you at the top, ya?

Dear friends, unleash your passion in trading and bring forth your belief, and you know what, your dream might be alot closer than what you have expected. I see you at the top, ya?

Sunday, June 11, 2006

11th June 06 - The Tipping Point of Trading

Months ago, I speed read through this book named "The Tipping Point: How Little Things Can Make a Big Difference" by Malcolm Gladwell. The focus of the book is on social 'epidemics' - any epidemic by definition must have reached a 'tipping point', a moment where the trend transits from being small-scale and contained to become a major explosive force.

An example of tipping point is the resurgence of the popularity of Hush Puppies, which had long been out of fashion, and were only sold in small shoe stores. Suddenly, a group of teenage boys in East Village, New York, found the cool to wear. Word-of-mouth advertising that these trend-setters were wearing the once-popular suede shoes set off an epidemic of fashion change, and boys all over America had to have the "cool" shoes. (taken from Amazon.com review of the book)

Being a trading coach, I am exposed to hundreds of aspiring traders who wants to make big bucks from trading. I know you are one too, isn't it? After months of observation, interestingly, some of the traders whom I know after much perserverance have reached Tipping Point and has switched from CONSISTENTLY UNPROFITABLE to now, CONSISTENTLY PROFITABLE month after month ... ...

To rise from tininess to greatness in trading, I believe there's 3 important ingredients, namely TIME, ATTITUDE and FOCUS.

In trading, we need time to develop and fine-tune our trading style. Everyone trades with a different style due to differing perceptions of fear and greed. The system advocated by the trading course you've just attended might not be suitable for you if it doesn't suit your risk appetite. I have known of traders who disregard that fact and in the quest of earning back their course fee lost all of their trading capital. Talking about time, we also need time to make mistakes so that we can learn from them and better ourselves. In trading, mistakes cost money and regardless of our account size, we can't afford to repeat the mistakes.

Attitude refers to our mindset in this game. Honestly speaking, how many of you have a "trade to win" mindset before entering any trade or is it more of "Let's hope the market goes my way"? Research has shown that 90% of traders who lose $$ succumb to the latter. To consistently profit from trading, we must have a winning mindset. A winner behaves like a sniper. He/she spends most of his/her time planning for the trade, the contingencies and weighing the risk-reward ratio. After deciding on the plan, the wait for the entry trigger begins. When the market trades to the entry level, no time is wasted. No hesistation on whether to enter or not as the game plan has been thought out and even rehearsed a few times before this moment. The trigger is pulled. BLAM ! One shot one kill! Believe me, this is one of the traits all the great traders have in common.

You can have the best technique and mindset but if you don't know exactly what you want to achieve out of trading, you will not go far in this game. Therein lies the importance of FOCUS. To start off, you must have a goal or outcome to focus on. For example, my goal is to make US$10 million from futures trading by end of 2008 and US$10 million per annum thereafter. Well, some of you may think this is a ridiculous amount but to my knowledge, some traders has done that before, meaning I can do it too :) With a quantum goal in place, next is to come out with the ways to achieve it. For example, I might want to make the US$10 million by making 10% off a US$100 million fund. Next step would to plan how to gather the fund within these 2

years ... As such, you can continue to break down the goal into smaller milestones and that immediate milestone to achieve 10% profit for June 2006 and say 12% for July 2006 and so on and so forth. With this, the mind has something to focus on and the you can look forward to every trading day as it would bring you closer to your dream.

Dear friends, I hope you like what I have shared. If you have any feedback, pls do drop me a comment if possible :)

An example of tipping point is the resurgence of the popularity of Hush Puppies, which had long been out of fashion, and were only sold in small shoe stores. Suddenly, a group of teenage boys in East Village, New York, found the cool to wear. Word-of-mouth advertising that these trend-setters were wearing the once-popular suede shoes set off an epidemic of fashion change, and boys all over America had to have the "cool" shoes. (taken from Amazon.com review of the book)

Being a trading coach, I am exposed to hundreds of aspiring traders who wants to make big bucks from trading. I know you are one too, isn't it? After months of observation, interestingly, some of the traders whom I know after much perserverance have reached Tipping Point and has switched from CONSISTENTLY UNPROFITABLE to now, CONSISTENTLY PROFITABLE month after month ... ...

To rise from tininess to greatness in trading, I believe there's 3 important ingredients, namely TIME, ATTITUDE and FOCUS.

In trading, we need time to develop and fine-tune our trading style. Everyone trades with a different style due to differing perceptions of fear and greed. The system advocated by the trading course you've just attended might not be suitable for you if it doesn't suit your risk appetite. I have known of traders who disregard that fact and in the quest of earning back their course fee lost all of their trading capital. Talking about time, we also need time to make mistakes so that we can learn from them and better ourselves. In trading, mistakes cost money and regardless of our account size, we can't afford to repeat the mistakes.

Attitude refers to our mindset in this game. Honestly speaking, how many of you have a "trade to win" mindset before entering any trade or is it more of "Let's hope the market goes my way"? Research has shown that 90% of traders who lose $$ succumb to the latter. To consistently profit from trading, we must have a winning mindset. A winner behaves like a sniper. He/she spends most of his/her time planning for the trade, the contingencies and weighing the risk-reward ratio. After deciding on the plan, the wait for the entry trigger begins. When the market trades to the entry level, no time is wasted. No hesistation on whether to enter or not as the game plan has been thought out and even rehearsed a few times before this moment. The trigger is pulled. BLAM ! One shot one kill! Believe me, this is one of the traits all the great traders have in common.

You can have the best technique and mindset but if you don't know exactly what you want to achieve out of trading, you will not go far in this game. Therein lies the importance of FOCUS. To start off, you must have a goal or outcome to focus on. For example, my goal is to make US$10 million from futures trading by end of 2008 and US$10 million per annum thereafter. Well, some of you may think this is a ridiculous amount but to my knowledge, some traders has done that before, meaning I can do it too :) With a quantum goal in place, next is to come out with the ways to achieve it. For example, I might want to make the US$10 million by making 10% off a US$100 million fund. Next step would to plan how to gather the fund within these 2

years ... As such, you can continue to break down the goal into smaller milestones and that immediate milestone to achieve 10% profit for June 2006 and say 12% for July 2006 and so on and so forth. With this, the mind has something to focus on and the you can look forward to every trading day as it would bring you closer to your dream.

Dear friends, I hope you like what I have shared. If you have any feedback, pls do drop me a comment if possible :)

Thursday, June 08, 2006

8th June 06 - Seasonality: What Season Is It Now?

The Asian markets bleed once again today! I shorted twice on Taiwan and made US$330 per contract. Some of my fellow trader friends followed my lead and made some money too, isn't that nice? I thank them again for believing in and trusting me :)

Once again, the typical headlines that follows this kinda sell-off are "Share prices tumbled across board ... nervous trade ... with investors fearing further US interest rate hikes would fuel inflation and stunt economic growth".

In my opinion, news/headlines are always late and thus I cannot rely on them to help me fatten my trading account. The news are probably good for a hindsight coffee talk after the money is made :)

Tell you a secret - I based 30% of my trading decision on this interesting phenomenon called SEASONALITY and it does help to bring in the buck IF AND ONLY IF YOU BELIEVE IT !!!

The formal definition of seasonality is "A characteristic of a time series in which the data experiences regular and predictable changes which recur every calendar year". For example, as mentioned in Investopedia, there's a January effect where "at the beginning of January, investors return to equity markets with a vengeance, pushing up prices of mostly small cap and value stocks".

Talking about seasonality as the World Cup nears, can't help but to share with you my version of "World Cup Effect". As I compare the charts of the Dow Jones Industrial Average (DJIA) this year and that of the previous World Cup (2002), there's an uncanny similarity. Both charts registered a sell-off in the market which started on mid May (20th May for 2002 and 11th May f0r 2006) with similar selling momentum. Based on chart patterns in June - July 2002, the current sell-off could continue gradually till mid July, with DJIA possibly reaching 9,000 points.

DJIA going back to 9,000 ??? I bet most of you think I am crazy ... Whether it comes true or not, I am not really interested. Even if I am RIGHT but I didn't trade on this move and make $$$, what's the point right?

As you are thinking right now, you begin to make sense of why 70% of my initiated positions since May were on the short side. Cool, ya ?

Once again, the typical headlines that follows this kinda sell-off are "Share prices tumbled across board ... nervous trade ... with investors fearing further US interest rate hikes would fuel inflation and stunt economic growth".

In my opinion, news/headlines are always late and thus I cannot rely on them to help me fatten my trading account. The news are probably good for a hindsight coffee talk after the money is made :)

Tell you a secret - I based 30% of my trading decision on this interesting phenomenon called SEASONALITY and it does help to bring in the buck IF AND ONLY IF YOU BELIEVE IT !!!

The formal definition of seasonality is "A characteristic of a time series in which the data experiences regular and predictable changes which recur every calendar year". For example, as mentioned in Investopedia, there's a January effect where "at the beginning of January, investors return to equity markets with a vengeance, pushing up prices of mostly small cap and value stocks".

Talking about seasonality as the World Cup nears, can't help but to share with you my version of "World Cup Effect". As I compare the charts of the Dow Jones Industrial Average (DJIA) this year and that of the previous World Cup (2002), there's an uncanny similarity. Both charts registered a sell-off in the market which started on mid May (20th May for 2002 and 11th May f0r 2006) with similar selling momentum. Based on chart patterns in June - July 2002, the current sell-off could continue gradually till mid July, with DJIA possibly reaching 9,000 points.

DJIA going back to 9,000 ??? I bet most of you think I am crazy ... Whether it comes true or not, I am not really interested. Even if I am RIGHT but I didn't trade on this move and make $$$, what's the point right?

As you are thinking right now, you begin to make sense of why 70% of my initiated positions since May were on the short side. Cool, ya ?

Tuesday, June 06, 2006

6th June 06 - The Story Behind Opening Price

Everyday, when the OPENING PRICE is flashed, somebody made a fortune while somebody leaves the game. Trading is a zero-sum game: when one wins, somebody else must lose.

Overnight gaps can be one's best friend or one's worst enemy! If one recklessly leave an overnight position, HOPING the gap will act in his/her favor on the following day, most of the time, it seems to act against him/her, isn't it? Especially when HOPE is in the picture ... ...

The killer comes when one have an excessive overnight position and the whole position turns against him/her at the OPENING PRICE. When the painful decision to cut loss came into realisation, he/she leaves the game ... ...

My friends, as long as we are in the game of trading, there always exist the possibility that one day we might be invited or forced to the EXIT. The next mistake which is too dear to pay for might just be IT.

Respect the market and it will pay you dividends. Mess with it and it will show you to the door.

Overnight gaps can be one's best friend or one's worst enemy! If one recklessly leave an overnight position, HOPING the gap will act in his/her favor on the following day, most of the time, it seems to act against him/her, isn't it? Especially when HOPE is in the picture ... ...

The killer comes when one have an excessive overnight position and the whole position turns against him/her at the OPENING PRICE. When the painful decision to cut loss came into realisation, he/she leaves the game ... ...

My friends, as long as we are in the game of trading, there always exist the possibility that one day we might be invited or forced to the EXIT. The next mistake which is too dear to pay for might just be IT.

Respect the market and it will pay you dividends. Mess with it and it will show you to the door.

Friday, June 02, 2006

2nd June 06 - What you perceive will be your reality !

"If you think you can, or if you think you cannot, you are right"

Henry Ford

SAY OUT LOUD the statement below

--> "Don't think of a pink elephant, don't think of a pink elephant"

How many of you, whilst saying that statement has a pink elephant popping out in your mind? I believe most of you do. Research has shown that the unconscious mind does a bad job in "picking up" negation, as such words like DON"T will be dropped. To the unconscious mind, the statement will be "Think of a pink elephant, think of a pink elephant".

How is this relevant to trading?

Friends, you will now think twice when you say "I DON'T want to lose in this trade". Remember the above quote from Henry Ford ... ...

Henry Ford

SAY OUT LOUD the statement below

--> "Don't think of a pink elephant, don't think of a pink elephant"

How many of you, whilst saying that statement has a pink elephant popping out in your mind? I believe most of you do. Research has shown that the unconscious mind does a bad job in "picking up" negation, as such words like DON"T will be dropped. To the unconscious mind, the statement will be "Think of a pink elephant, think of a pink elephant".

How is this relevant to trading?

Friends, you will now think twice when you say "I DON'T want to lose in this trade". Remember the above quote from Henry Ford ... ...

Subscribe to:

Posts (Atom)