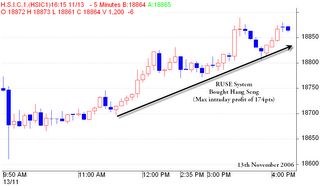

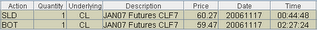

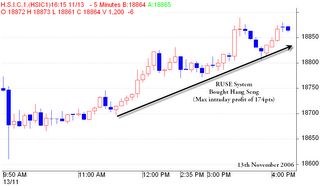

It has been a month or so since the RUSE system last gave an entry. Well, looking from the entries (see above charts) today, it seems like a wait worthwhile ...

For those who are new to this blog, RUSE is a highly accurate trading system to trade up to 5 Asian markets (Nikkei, Kospi, Hang Seng, SIMSCI, TW) at a single go, relying on synchronised momentum-based reversal techniques to catch the markets as it turns.

What I really like about RUSE is that the risk-reward ratio is extremely attractive (can be up to 1:4, meaning risk $1 to make $4)

I have shared this system during my Trading Mastermind Programme. Believed some of my graduates benefited from this move.

Finally, a run-down of the maximum intraday profit (per contract) for RUSE system today:

1) Nikkei - 120pts (S$792)

2) KOSPI - 1.3prs (S$1,084)

3) Hang Seng - 174pts (S$1,740)

4) SIMSCI - 0.8pts (S$160)

5) TW - 1.1pts (S$170)

Slurp slurp, looking forward to the next opportunity :)

A trade which I waited for weeks. I think my patience paid off :)

A trade which I waited for weeks. I think my patience paid off :)

Although my system is over 90% accurate and only generate 1 stop loss in 5 years, I have to acknowledge the fact that Nikkei, Hang Seng and SIMSCI ended up strongly nearer to their highs. At the same time, this system is mechanical so taking every trade is necessary for consistent profitability.

Although my system is over 90% accurate and only generate 1 stop loss in 5 years, I have to acknowledge the fact that Nikkei, Hang Seng and SIMSCI ended up strongly nearer to their highs. At the same time, this system is mechanical so taking every trade is necessary for consistent profitability.